Our Best Selling cars in Kenya |

||

| Toyota Land Cruiser Prado | Nissan Tida | Audi A4 |

| Toyota Hiace Van | Nissan March | BMW 1 Series |

| Toyota Harrier | Nissan Note | Mercedes Benz A Class |

| Toyota Premio | Nissan Caravan Van | Mercedes Benz B Class |

| Toyota Corolla Axio | Nissan Dualis | Volkswagen Tiguan |

| Toyota RAV4 | Nissan Caravan | Volkswagen Polo |

| Toyota Vanguard | ||

| Toyota Mark X | Honda Fit | |

| Toyota Belta | ||

| Toyota Vitz | ||

| Toyota Passo Sette | ||

A Guide to Importing a Car to Kenya

Please note: This guide is just an outline to the process and regulations of motor vehicle importation / exportation to Kenya and cannot be used as hard and fast rules due to various variables affecting importation of motor vehicles to Kenya . If in doubt, please do not hesitate to contact us.

The three main regulations when considering importing / exporting a car to Kenya are:

1) Age Limit: In 2017 only vehicles manufactured in the year 2010 and onwards will be allowed to be imported into Kenya

2) Left Hand Drive Vehicles: All left hand drive vehicles are not allowed for registration unless they have a special purpose.

3) Road Worthiness: All motor vehicles imported into Kenya must be inspected prior to shipment by QISJ for road worthiness.

Documents required to clear the vehicle

Original passport to confirm the above

Vehicle Log book to confirm the above

Bill of Lading

Pre Inspection Certificate

KRA Pin Card

The duty payable on the importation of a motor vehicle is as follows : -

Import duty at 25%, Excise duty at 20% and VAT at 16% are payable cumulatively and in that order. i.e,

o Import duty is 25% of the Customs value (CIF) of the vehicle i.e. 25% of (Invoice value + Insurance + Freight charges)

o Excise duty is 20% of (Customs Value + Import Duty)

o VAT is 16% of (Customs Value + Import Duty + Excise Duty)

Further, an Import Declaration Fee (IDF) of 2.25% of the CIF is also charged subject to a minimum of Ksh. 5,000 payable in advance on application.

Clearance through Customs :-

To clear the vehicle through Kenya Customs, an importer will have to contract a licensed clearing agent to process their declaration in the Simba 2005 system. A listing of licensed clearing agents is available

The clearing agent will lodge an import entry in Simba 2005 system, pay the required duties and taxes and present all the relevant documentation for Customs to pass the entry.

The documents required are : -

* Original Commercial Invoice.

* Original Bill of Landing.

* Import Declaration Form obtained from Customs.

* Authentic Original Logbook from country of origin.

* Pre shipment Inspection Certificate

*Export certificate , etc

For Returning resident:

A person changing residence from a place outside Kenya to a place within Kenya where that person has been residing outside Kenya for a period of at least two years and has not resided in Kenya for a period(s) amounting in aggregate to ninety days or more within the two years immediately before this return to Kenya .

A returning resident may import one exempt motor vehicle "(excluding buses and minibuses of seating capacity of more than 13 passengers and load carrying capacity exceeding two tonnes)" Provided that:

i) the person has attained the age of eighteen years; and

ii) the vehicle was used by him outside Kenya for at least three hundred and sixty days (excluding the period of voyage in the case of shipment)

iii) the vehicle is owned and registered in his name and/or his spouse, and where the motor vehicle is purchased on hire purchase terms, the first instalment in respect thereof was paid and delivery taken at least three hundred and sixty days prior to importation.

Current Retail Selling Price (CRSP): The amount you paid for your car does not matter. The Kenya Revenue Authority (KRA) publishes the current retail-selling price and clearing and forwarding agents use these prices when they calculate or charge duties.

Custom Value: This is the value of an import as determined by customs department of the Kenya Revenue Authority. It is essential in determining the amount of duty that must be paid on an imported item.

Age of Registration: The year the car was manufacture it not necessarily the same year as the car registration data. The import duty is calculated using the registration age. Granted, it is illegal to import an 8-year old and beyond motor vehicle into Kenya subject to the Kenya Bureau of Standards ( KEBS KS 1515:2000 quality standard).

Engine Capacity: The larger the engine capacity, the higher the import duty.

Excise Duty: According to the Excise Duty Act of 2015 is levied at KSh150, 000 for a car less than 3 years old while Ksh200,000 for a car more than 3 years old.

Value Added Tax (VAT): The VAT is the amount the Kenya Revenue Authority (KRA) charges the 16% value added tax (VAT) to the buyer.

How to Buy :-

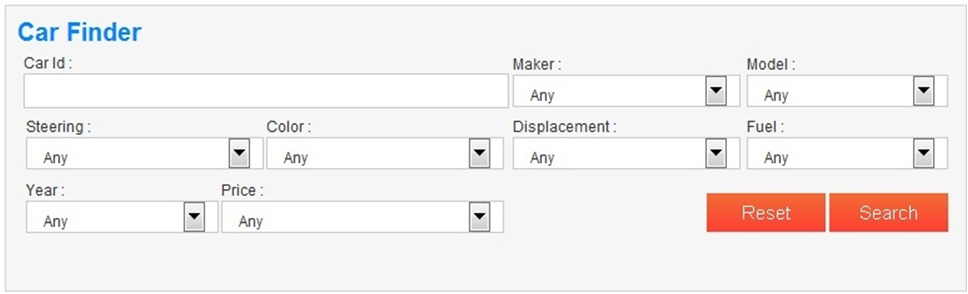

First go to Our 1) CARLAND -JAPAN site, 2) Click SIGN IN and make your User ID and Password, 3) For Login Click here LOGIN and 4) Find Your car from Our STOCK LIST

Carland Japan is the best place to find the vehicle of your dreams car. On carland -Japan, you can browse by Make, Model, Body Type, Year, Price, etc. Here you can narrow down your search to the exact car that you are looking for. Please select maker/car name/model year etc. then search used-car you want to purchase.

![]() My list is a list where You can put your selected car for later view. Click "add to my list button" to put in my list.

My list is a list where You can put your selected car for later view. Click "add to my list button" to put in my list.

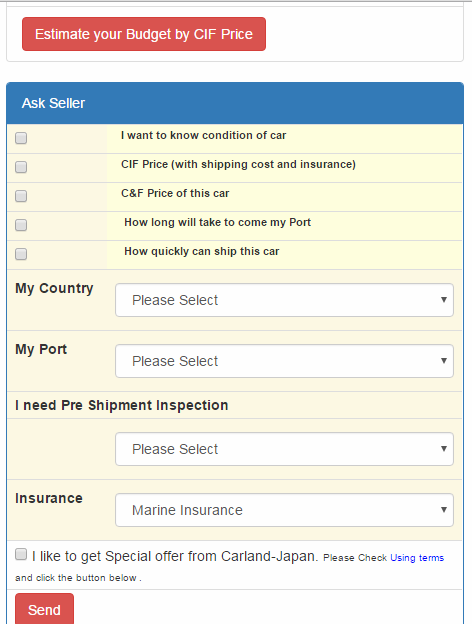

Once you have chosen a vehicle, you can use the "Contact Seller" form at the right side of the vehicle listing page to contact us. Or You can also always use" Send Multiple Enquiry button to send enquiry for Selected car at a time Or you can click more information button to see more picture, more information and send Enquiry from car details information page.

Our Seller will reply your quotation including vehicle Price /shipping charges/inspection fees/Marine Insurance etc by mail. Seller will reply your quotation ASAP, but you may be received quotation from a few hours to 2business days.

Price of vehicle as following. |

| FOB : Price of vehicle |

| C&F: Price of vehicle+ Freight |

| CIF : Price of Vehicle+Freight + Insurance |

| Negotiate Price with seller as soon as you confirm price request for Proforma invoice Please print PRO-FORMA INVOICE and send PRO-FORMA INVOICE with your signature to our company |

Safety Pay: Our Payment system is secure by SafetyPay system , So Your payment is safe ans secure

Please transfer amount of money to our company bank account and then send copy of TT as soon as you receive PRO-FORMA INVOICE

After confirmation of receipt of payment, our seller will process export. After procedure completion, we will shipping schedule

After the car was loaded into the ship, Seller will send B/L Export certificate , insurance documents and INVOICE to your address by express service

Once vehicle arrive in your country, please follow your country's procedure to receive vehicle. We will be glad to hear that you receive the vehicle

For More Information Contact to our Carland-Japan Kenya Center

**** Email To Kenya Center